CyberZ, Inc. (Head office: Shibuya-ku, Tokyo; President: Takahiro Yamauchi), which is a consolidated subsidiary of CyberAgent, Inc. (Head office: Shibuya-ku, Tokyo; President: Susumu Fujita; listed in the first section of Tokyo Stock Exchange; securities code: 4751), carried out “the survey on the smartphone ad market trend in 2015*1” in cooperation with Seed Planning, Inc. (Head office: Bunkyo-ku, Tokyo; President: Yoshio Umeda).

In this survey, smartphone ads were classified into “search-linked ads,” “display ads,” and “pay-per-action ads”*2, the annual amount of posted smartphone ads was estimated (target period: Jan. 2014 to Dec. 2014), and the market scale was forecasted*3. This time, we forecasted the market scale of “native ads”*4, for which needs from sponsors have grown since the end of last year. The results of this survey are as follows.

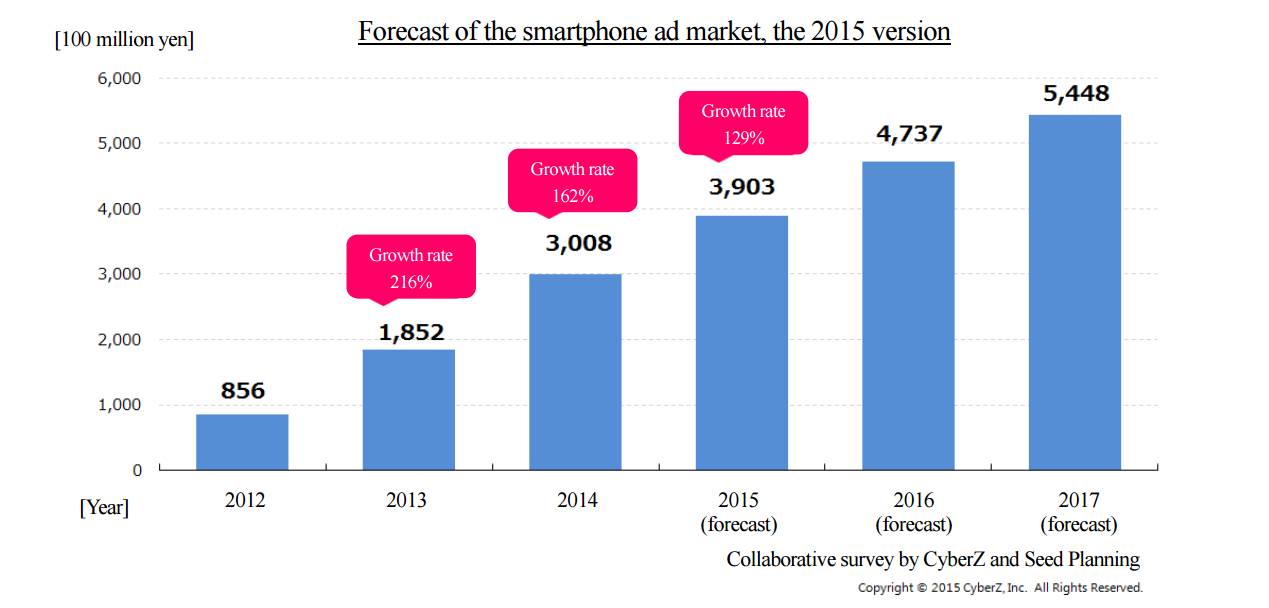

■ Estimation of the scale of the smartphone ad market in 2014

The scale of the smartphone ad market in 2014 is 300.8 billion yen, which is 162% of the value for the previous year.

In 2014, the penetration rate of smartphone terminals in Japan exceeded 50%, and the main devices used for accessing the Internet shifted from PCs to smartphones on a full-scale basis. Social media, e-commerce sites, and digital contents, including movies and games, etc. are accessed increasingly by smartphones rather than PCs. Thanks to the advent of the advertisement media and formats utilizing the features of smartphones, the advertising services for smartphones have been diversified, and the environment for sponsors’ sales promotion via smartphones has been improved significantly. In this circumstance, the demand for smartphone ads from sponsors grew steeply like in the previous year, and then the scale of the smartphone ad market in 2014 was 300.8 billion yen (162% compared with the previous year), which considerably exceeds the forecast in the previous year: 230.4 billion yen. (The market scale of each ad service will be mentioned on the following page.)

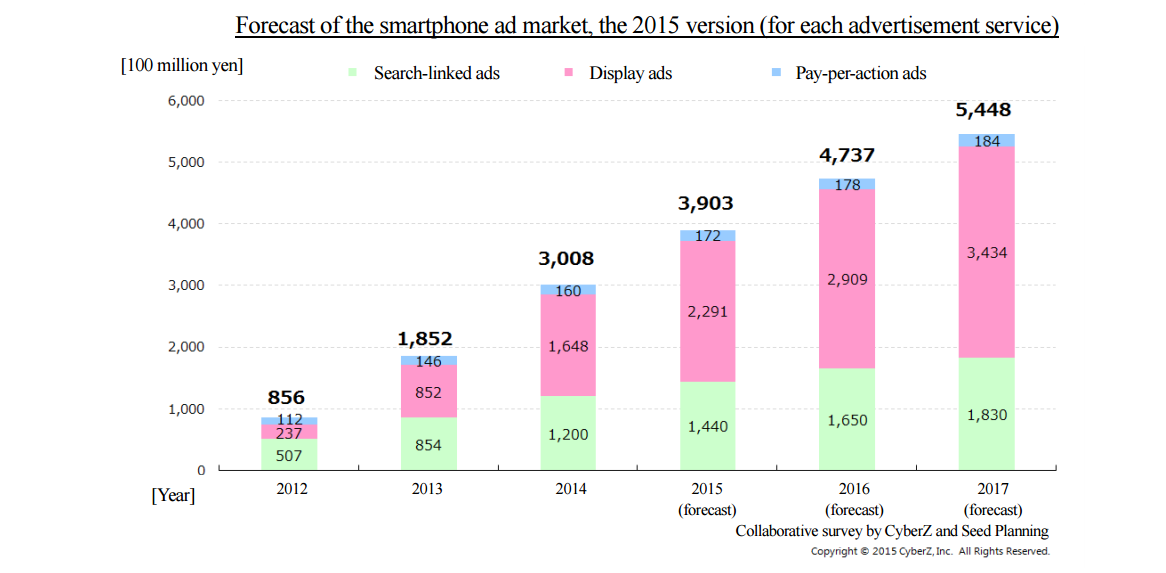

■ Trend of each smartphone ad service

The scale of the display ad market in 2014 rapidly grew to 164.8 billion yen, 193% compared with the previous year. The share of display ads exceeded 50% for the first time, driving the growth of the market scale.

As for the market scale of each smartphone ad service in 2014, the scale of the search-linked ad market was 120 billion yen (140% compared with the previous year), the scale of the display ad market was 164.8 billion yen (193% compared with the previous year), and the scale of the pay-per-action ad market was 16 billion yen (109% compared with the previous year). The share of the display ad market, whose growth rate is the highest, grew from 46% in the previous year to 54%.

The trend of each ad service is as follows.

【 Search-linked ads 】

The demand for search-linked ads kept increasing steadily in 2014, but the ad fee paid per search was sluggish. Compared with the growth rate till 2013, growth is becoming gentler. From now on, it will be necessary to accurately grasp which device users use to spend online; a PC, a smartphone, a website, or application software, and then allocate funds invested by sponsors more effectively, in order to achieve the sustainable growth of the demand for search-linked ads.

【 Display ads 】

Game developers inside and outside Japan demanded sales promotion, the budgets of leading sponsors that conduct e-commerce, financial businesses, etc. shifted from PC-targeted to smartphone-targeted ones, and advertising services were enriched, including new ad formats provided by leading social media, movie ads, and feed-type native ads. In this situation, the unit prices of display ads increased. As users browse smartphone media more often, the number of ad-network ads increased favorably from the previous year, and the stock for RTB ad distribution based on DSP, which had been mainly for PCs, expanded.

As for social media ads, it is possible to distribute meticulously-targeted ads according to the attributes, preference, interests, etc. of users, and so the number of posted ads skyrocketed, and the share of social media ads grew considerably from last year. Social media, news curation application, etc. started offering movie ad services on a full-scale basis, increasing options for smartphone-based advertisement.

【 Pay-per-action ads 】

As for pay-per-action ads, the number of titles promoted by game developers increased, but the unit prices for some advertisement services declined. Accordingly, the growth of the market scale is gentle. On the other hand, the movie ad service and the well-targeted ad service are stirring new demand.

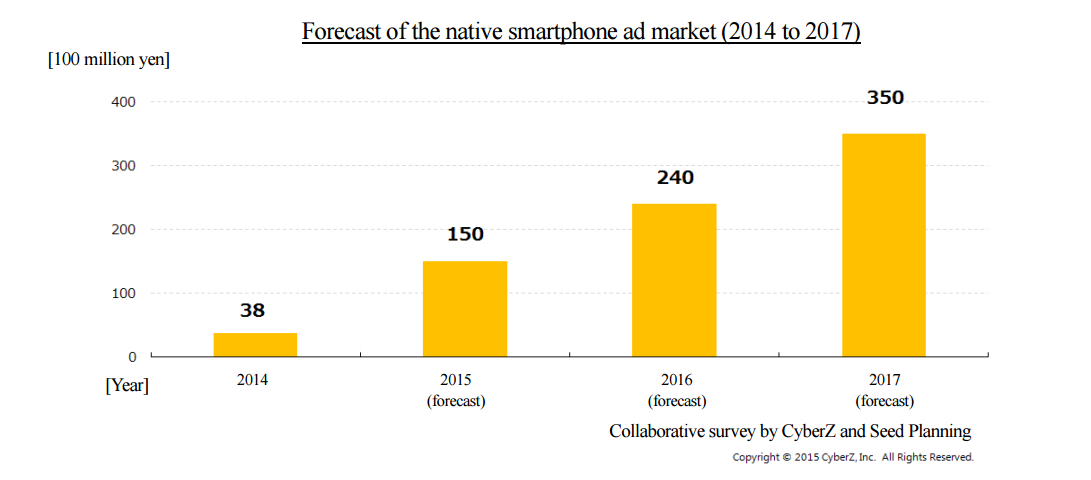

■ Forecast for the native smartphone ad market

From 2015, the demand for native smartphone ads grew rapidly.

Its market scale is estimated to reach 15 billion yen in 2015, and 35 billion yen in 2017.

In 2014, many smartphone-based advertisers started offering native advertisement services. For posting native ads, news curation application, etc. attracted attention as new media unique to smartphones. Native ads are expected to be popularized as the new format for smartphone ads, following the conventional display ads. It is predicted that in 2015, leading companies will enter this market, and so needs for posting ads will grow rapidly.

The definition of “native ads” and ideal formats of native ads are being discussed from various aspects inside and outside this business field. Under the theme of advertising services that would not be disliked by users, most people think that it is necessary to redefine existing ad services, while taking into account the discussions in the digital marketing field, and they are expected to keep changing. In this situation, the market is expected to grow while changing.

■ Smartphone ad market in 2015

The scale of the smartphone ad market in 2015 is 390.3 billion yen, 129% compared with the previous year. This indicates that growth rate remains high.

In 2015, it is expected that the shift of budget allocation targets from PC-targeted ads to smartphone-targeted ads in the Internet advertising market will continue, the needs for ads from sponsors that conduct game development, e-commerce, financial businesses, etc. inside and outside Japan will grow, and growth rate will be high. As targeting precision will improve with user data of sponsors and advertising technologies will be advanced, it is predicted that online marketing targeted at smartphone users will be sophisticated, and the enrichment of new advertising services, including movie and native ads, will energize the entire market.

As for the market scale of each advertising service, the market scales of search-linked ads, display ads, and pay-per-action ads are estimated to be 144 billion yen (120% compared with the previous year), 229.1 billion yen (139% compared with the previous year), and 17.2 billion yen (107% compared with the previous year), respectively. In 2015, it is expected that the needs for posting smartphone ads will steadily increase, as the lineup of smartphone-based advertising services will be enriched and the optimized ad distribution technology based on the cross-channel posting with PC-targeted ads will be diffused.

The search-linked ad market is expected to keep growing as users will use search engines more frequently, but growth rate is estimated to become gentle. The display ad market is expected to keep growing with a high growth rate because of the increase in demand for social media, native, and movie ads, and boost the growth of the smartphone ad market. The pay-per-action ad market is estimated to be healthy, as movie and targeted ads, etc. will be diffused while there is persistent demand from game developers.

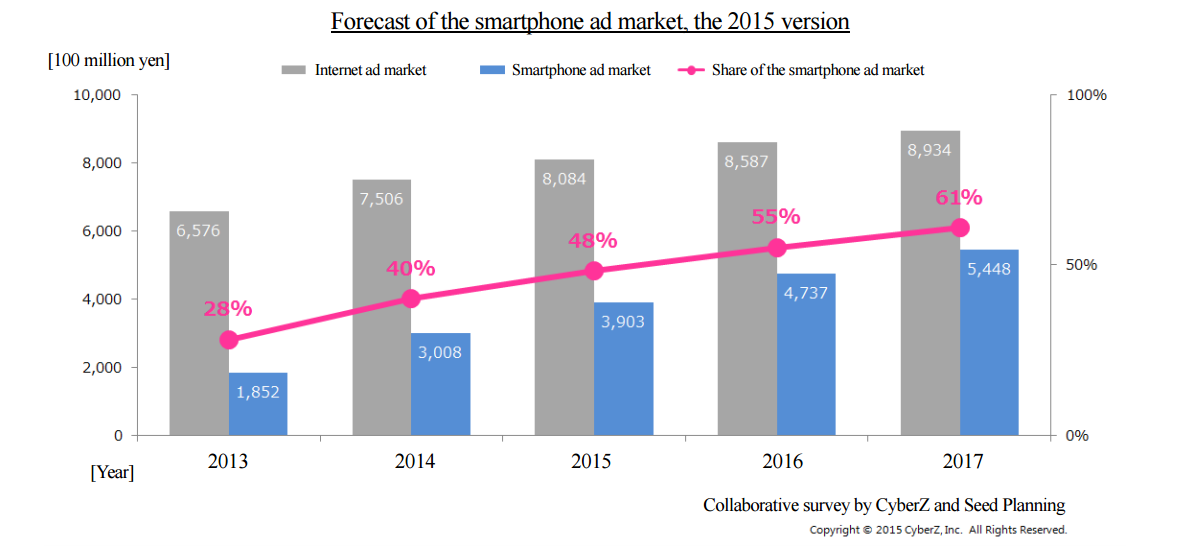

■ Outlook for the smartphone ad market

It is forecasted that the scale of the smartphone ad market will exceed 50% of the scale of the Interned ad market in 2016, and reaches 500 billion yen in 2017.

The smartphone ad market is expected to grow sustainably, as more users will spend online after accessing smartphone ads and the importance of smartphones will increase as a marketing channel that runs through online and offline services, although its growth rate is expected to be gentle from 2016. As a result, the market scale is expected to be 473.7 billion yen in 2016, and reach 55% of the total sales of the Internet ad market*5.

Our company aims to solve the problems with smartphone promotion and improve its effects, and will make efforts to expand the smartphone ad media in each country, and optimize the effects of advertisement.

※1 “The survey on the trend of the smartphone ad market” is conducted by CyberZ, Inc. in cooperation with Seed Planning, Inc. and released every year. In March 2013, the scale of the smartphone ad market was forecasted for the first time in Japan, and the 2013 and 2014 versions of the forecast have been released so far.

※2 In this survey, smartphone ads and each advertising service are defined as follows:

・Smartphone ads: Ads posted on websites and application software accessed by users with their smartphones, while being adjusted to screen size. It is assumed that the websites of sponsors linked by smartphone ads, too, are adjusted to the screen size of each smartphone.

・Search-linked ads: Ads displayed on the pages retrieved by a search engine, according to keywords inputted by users. “Content-linked ads” are categorized into “display ads.”

・Display ads: Movie and image ads in banner-type ad spots, and sponsored ads displayed as part of contents in media, including application software. Display ads are classified into “pure ads,” which are displayed on specific spots planned and sold by a media producer, and “ad-network/DSP ads,” which are distributed at once to several media by advertising firms called ad network providers and DSP operators, to estimate the market scale. The market scale in 2013 at the time of the release in March 2014 was revised, because the sales of firms were re-estimated.

・Pay-per-action ads: Cost-per-install (CPI) ads used mainly for promoting application software. Every time a user installs target application, some incentives, such as points, are added. Pay-per-action ads do not include CPA ads provided by web browser operators for increasing users or real affiliate marketing that is conducted at actual stores of cell phones, etc. for promoting the installation of application into the cell phones of users. From this year, CPI ads without incentives are included in addition to CPI ads with incentives for users.

※3 This survey was carried out with reference to the results of the interviews with related firms in the smartphone ad field, publicly available information, data owned by Seed Planning, etc.

※4 The native ads in this survey mean the ads in the infeed-type format, and do not include the infeed-type ads provided by Facebook and Twitter. The ads provided by news curation application software and the native ads of ad-network operators are included.

※5 In this survey, the scale of the Internet ad market was calculated based on the results of the interviews with related firms in the ad field, publicly available information, data owned by the survey host and Seed Planning, etc.

■ Outline of the survey

Survey host: CyberZ, Inc.

Survey period: From Nov. 2014 to Jan. 2015

Survey methods: Interview with smartphone ad market players, and gathering of data held by the survey host and the surveying institution, and publicly available information

Survey targets: Smartphone ad market and related markets

Surveying institution: Digital InFact (Seed Planning, Inc.)

* If you reprint or use any contents of this survey, please write “surveyed jointly by CyberZ and Seed Planning.”

■ Regarding CyberZ, Inc. (http://cyber-z.co.jp/)

Founded in 2009 as an advertisement marketing company specializing in smartphones, and supports the marketing of sponsors globally based on San Francisco Branch, etc. in Asia, the U.S., EU, etc. The smartphone ad solution tool “Force Operation X” provided by this company gauged the effects of advertisements for smartphone applications for the first time in Japan, and was accredited as one of “Mobile Measurement Partners” of Facebook, Inc. and also as a “Marketing Platform Partner” of Twitter, Inc. The number of tie-ups with leading media around the world, including iAd, Google, and LINE, is at the world’s top level. This company has promoted over 4,000 applications, and localized the functions according to the characteristics of each country and each region, including multilingual services.

■ Regarding Seed Planning/Digital InFact (http://digitalinfact.com/)

Established in October 2014, as an institution that evaluates the markets and services in the digital field and that is operated by Seed Planning, Inc. Its business contents include the collaborative researches with firms and groups, the evaluation of markets and services, and the publication of survey reports. It distributes the information on the structures and trends of markets in the digital field, which is rapidly changing, in a simple, understandable manner from unique perspectives.

■ Corporate Profile

Corporate name: CyberZ, Inc. (http://cyber-z.co.jp/)

Location: 16th floor of Shibuya Mark City, 1-12-1 Dougenzaka, Shibuya-ku, Tokyo

Date of establishment: April 1, 2009

Representative: President Takahiro Yamauchi

Business contents: Smartphone-based advertisement business

■ Inquiries about this press release

Kabashima, in charge of publicity

CyberZ, Inc.

E-mail: press@cyber-z.co.jp

Tel:03-5459-6276 Fax:03-5428-2318